Come grow with us in the US in Thailand in China in Korea in the Philippines in Taiwan in Hong Kong

Contact Us

US: +1 512 898-9222

SG: +65 3138-4148

EMAIL: Inquiry@asiaactual.com

Sources and Links

Indonesia Market Summary and Registered Devices Review

Published on: October 23, 2020

Market Snapshot

In recent years, the government has made healthcare a priority for the 261 million Indonesians, providing a lot of potential for medical device manufacturers of all technology levels. The government has also taken numerous steps to curb corruption through their online e-catalogue and other methods which has helped bring in more foreign companies and investment. According to the International Trade Administration, Indonesia imported $1.55 billion worth of medical devices in 2019, with about 20% coming from China, 15% from Germany, and 11% from the US. There is an estimate 2,877 hospitals (1,047 public / 1,830 private) with many public hospitals being consolidated to help increase efficiency1.

Foreign manufacturers are able to own up to 49% of a local importer-distributor but will need to meet additional production requirements if they want to own 100%. This, combined with a history of corruption, means manufacturers should continue to work with an independent partner that can ensure local regulations are met while maintaining complete control over their product and its marketability. Medical equipment is also subject to an import tax that varies depending on the type, along with the standard 10% VAT1. Halal certification is also currently not required but will begin to be implemented in 2021.

Who’s Registering Products in Indonesia

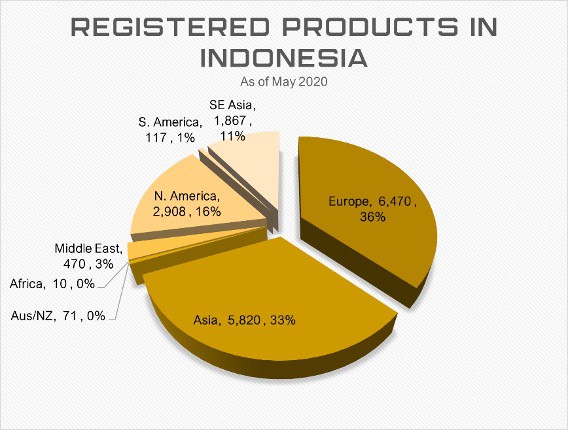

The Indonesian Ministry of Health maintains an e-catalogue of products available for sale as part of their effort to maintain transparency and combat corruption. Asia Actual has been able to gain unique insight into the registered products to help medical device manufacturers better evaluate the market specific to their product type. Indonesia imports 90% of their medical devices, especially when it comes to high tech therapies and hold only 9.84% of product registrations2.

As in most countries, IVDs are highly saturated product categories but we’ve also found that equipment for surgery, general hospital use and radiology are competitive as well. Regarding manufacturers, we found that similar categories were also saturated as seen below.

Product Category Snapshot – Gastro-Urology

| Type | Products | Countries of Origin |

|---|---|---|

| Diagnostic | 312 | 21 |

| Prosthetics | 4 | 1 |

| Surgical | 189 | 17 |

| Therapeutic | 369 | 30 |

Imported Product Categories by Country of Origin

| Country of Origin | Products | Importers |

|---|---|---|

| China | 3,280 | 462 |

| Germany | 3,074 | 208 |

| United States | 2,575 | 203 |

| Indonesia | 1,583 | 191 |

| Korea | 817 | 178 |

| Italy | 517 | 18 |

| Japan | 715 | 99 |

| India | 430 | 86 |

| Taiwan | 288 | 84 |

| United Kingdom | 639 | 79 |

Top 10 Categories by Products Registered

| Product Category | Products | Importers |

|---|---|---|

| Clinical Chemistry Test Systems | 1,964 | 140 |

| Surgical Equipment | 1,730 | 304 |

| Equipment General Hospital and Personal Therapeutic | 1,069 | 213 |

| Diagnostic Radiology Equipment | 758 | 136 |

| Anesthesia Equipment Therapeutics | 698 | 168 |

| General Hospital Equipment and Other Individuals | 624 | 64 |

| Immunology Test Systems | 624 | 64 |

| Reagent Serology | 602 | 86 |

| Prosthetic Orthopedic Equipment | 524 | 60 |

| Clinical Laboratory Equipment | 522 | 108 |

Top 10 Categories by Importers

| Product Category | Products | Importers |

|---|---|---|

| Surgical Equipment | 1,730 | 304 |

| Equipment General Hospital and Personal Therapeutic | 1,069 | 213 |

| General Hospital Equipment and Other Individuals | 624 | 197 |

| Anesthesia Equipment Therapeutics | 698 | 168 |

| Clinical Chemistry Test Systems | 1,964 | 140 |

| Diagnostic Radiology Equipment | 758 | 136 |

| Obstetrics and Gynecology Equipment Surgery | 375 | 114 |

| Clinical Laboratory Equipment | 522 | 108 |

| Gastroenterology-Urology Therapeutic Equipment | 369 | 103 |

| Diagnostic Cardiology Equipment | 431 | 95 |

If you would like to learn more about your product category, please reach out here for support and if you want to explore the e-catalogue yourself, please find directions here or along the sidebar.

COVID Update

As of October 21, the Health Ministry reported an additional 4,267 new cases, bringing the total number of infections to 373,109 with 12,857 deaths. Cases have plateaued in the last month after reaching a daily high of 4,823 new infections on September 253. Indonesia currently has 376 laboratories with a combined testing capacity of 40,000 specimens per day to serve the population of 260 million people. The government has also taken some significant steps, capping the cost of COVID tests, setting a goal of obtaining 670,000 vials of remdesivir by the end of 20204, and have set up the National Economic Recovery Task Force with a budget of IDR 695.2 trillion budget, the majority spent on social protection programs. Some businesses are able to open to 25% but high-risk locations like karaoke bars and night clubs remain closed with contact tracing being implemented among all open businesses5.

Indonesia and Singapore have also implemented a Reciprocal Green Lane (RGL) agreement that allows qualifying essential businesspeople to travel back and forth. Only citizens of Singapore and Indonesia are eligible to apply for this program5.

While the government’s hospital budget has doubled in 2020 from IDR 9 trillion (US$613.5 million) to IDR 18 Trillion (US$1.2 billion), most of the budget will be spent on PPE and other pandemic specific products. When combined with the APBD (Regional Revenue Expenditure Budget), and private budgets, the total expenditure on medical equipment in Indonesia averages around IDR 50 trillion (US$3.4 billion) per year. Even though upgrading hospitals and the healthcare infrastructure remain a top priority for the Indonesian government; upgrades, elective surgeries, and dentist offices will likely decline until COVID pandemic can be addressed. As a result, medical equipment transactions are only at about half of what they would be under normal conditions this year.

Who’s Registering Products During COVID

The Ministry of Health has provided priority pathways and accelerated One Day Service (ODS) services for licensing medical devices used for Covid-19 management. During the period January 1, 2020 – June 30, 2020, there was a significant increase in product approval for medical device and Household Health Supplies (PKRT) due to this relaxation, along with PPE. Apart from domestic products, the impact of this relaxation has also increased the number of imported products being approved. Many of the imported products include medical devices used to carry out diagnostic tests for Covid-19 patients such as PCR devices, reagents, and swab kits.

The below table is a snapshot of products that have been approved in the first half of this year compared to last year7.

Table 1. Personal Protective Equipment Approval

| No | Product | Domestic products | Imported products | ||||||

| Approval | Applicant | Approval | Applicant | ||||||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | Surgical Masks | 104 | 172 | 28 | 102 | 31 | 32 | 15 | 22 |

| 2 | KN95 Masks | 0 | 5 | 0 | 4 | 1 | 14 | 1 | 11 |

| 3 | Coveralls | 0 | 212 | 0 | 135 | 0 | 13 | 0 | 13 |

| 4 | Surgical Gowns | 1 | 29 | 1 | 23 | 13 | 4 | 2 | 4 |

| 5 | Hair Nets | 18 | 8 | 11 | 7 | 5 | 0 | 4 | 0 |

| 6 | Examination Gloves | 28 | 17 | 12 | 10 | 63 | 32 | 29 | 12 |

| 7 | Surgical Gloves | 7 | 9 | 3 | 6 | 23 | 30 | 15 | 15 |

| 8 | Goggles | 0 | 5 | 0 | 4 | 0 | 7 | 0 | 5 |

| 9 | Shoe Covers | 1 | 12 | 1 | 11 | 0 | 0 | 0 | 0 |

Table 2. Hand Sanitizer and Disinfectant Approval

| No | Product | Domestic Products | Imported Products | ||||||

| Approval | Applicant | Approval | Applicant | ||||||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | Hand Sanitizers | 38 | 1006 | 28 | 398 | 8 | 54 | 8 | 21 |

| 2 | Disinfectants | 52 | 337 | 31 | 176 | 14 | 16 | 7 | 9 |

If you would like to learn more about registered products in Indonesia, support evaluating your product’s potential in the market, or want to learn more about the registration process, please contact Asia Actual today for support.