Come grow with us in the US in Thailand in China in Korea in the Philippines in Taiwan in Hong Kong

Contact Us

US: +1 512 898-9222

SG: +65 8800-3197

EMAIL: Inquiry@asiaactual.com

India’s Public Hospitals Advised to Purchase From Local Manufacturers

Published on: June 15th, 2021

Initiative to Significantly Effect Low Risk Imported Devices

On March 25, 2021, a notification was released by the Department of Pharmaceuticals (DoP) advising public hospitals in India to purchase specific product categories only from local manufacturers. The notification listed 19 more device categories such as gloves, syringes, orthopedic products, x-ray machines, and more. This means that local manufacturers will now be given priority on 154 total product categories, making entry into the Indian market more complicated for Class I foreign medical device manufacturers. Currently, the majority of imports come from the U.S. and China, but this move aims to put India on equal grounds. As the Business Standard article states, the government expects this initiative to reduce foreign imports by RS 4,000 crore which equates to US$521 million (Note: 1,000 Crore = 10 billion Rupees and ~US$130 million).

India’s Effort to Boost Local Manufacturers in India

This new announcement comes on the heels of multiple government endeavors to boost the local medical device manufacturing industry. Last summer, India’s chemical minister announced plans to encourage local manufacturing of drugs and medical devices to reduce reliance on foreign imports, especially from China. According to a Reuter’s article, “India, often called ‘pharmacy of the world’, has a robust $40 billion pharmaceutical sector that is seen as a reliable supplier of generic drugs. But it is reliant on China for around 70% of active pharmaceutical ingredients, or raw materials, which are often cheaper to import than make.” Furthermore, according to Sadananda Gowda, the federal minister for chemicals and fertilizers, “around 86% of materials used to make medical devices are imported.”

India’s Reliance on Imported Medical Devices

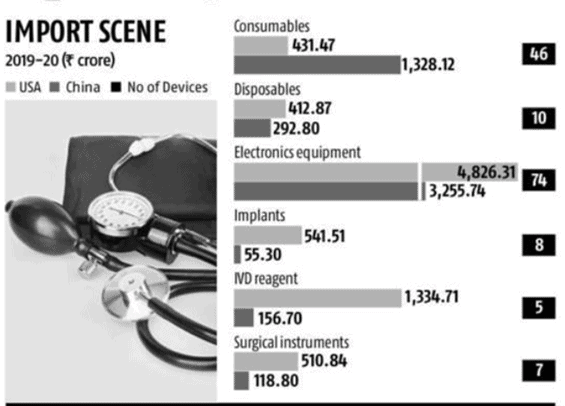

India is currently heavily reliant on foreign imported medical devices, especially when it comes to high tech devices. This current move intends to benefit local manufacturers in India by specifically targeted low tech devices with an estimate retail value of 1 trillion crore (US$ 13.7 billion). The most effected product categories include consumables, disposables, electronic equipment, implants, IVD reagents, and surgical instruments with estimated market value shown below in crore. Most of India’s imports come from the US and China, with the latter having significant pricing success when it comes to disposable products like syringes and gloves, leading to 75% market share in some categories. US manufacturers on the other hand, also maintain strong market shares of 75% or more in IVD reagents, surgical instruments, and implants.

Recommendations for Foreign Manufacturers

At this time, it is estimated that there are more than 2,500 medical device manufacturers in India compared to almost 10,000 medical device companies in the United States. Foreign manufacturers are facing a changing commercial landscape in India as the government continues to release initiatives to benefit local manufacturers. India’s new initiatives are primarily affecting low risk foreign devices, but may eventually expand to high-risk devices as local manufacturers increase their medical expertise and begin producing competitive products. It has been a long focus of the Indian government to boost domestic production of not only pharmaceutical products, but also medical devices. Facing this increasing challenge, one recommendation for foreign manufacturers would be to consider setting up a local entity to expedite registration requirements, simplify the registration process and tax requirements, and improve their chances of winning crucial tenders with public health care providers.

Grow With Us

Asia Actual is available to help navigate the complex medical device registration requirements and regulatory pathway for medical device and IVD distribution in India.

Contact Asia Actual for a free consultation to discuss the potential of your medical device or IVD in the Indian medical market.