Come grow with us in the US in Thailand in China in Korea in the Philippines in Taiwan in Hong Kong

MEDICAL DEVICE REGISTRATION IN HONG KONG:

Why a voluntary process is mandatory for sales growth

Published on: July 10, 2020

Hong Kong has long been a regional hub for the medical device industry. Despite growing competition in Singapore and Macau, Hong Kong remains a leading market for manufacturers. While Hong Kong’s Medical Device Division (MDD) does not currently require formal approval prior to importing products into the Special Administrative Region, manufacturers that are serious about growing sales in Hong Kong/Southeast Asia should consider registration mandatory.

The primary reasons manufacturers should participate in the voluntary registration system are:

- Access to the Majority of the Market: Public hospitals in Hong Kong will ONLY purchase registered products. Public facilities make up the majority of healthcare services in Hong Kong, handling about 71% of hospital needs, 32% of inpatient curative services and 26% of outpatient services, according to 2019 data from Hong Kong’s Domestic Health Accounts (DHA)

- Beat the Rush: New regulations have been in development for a while and by participating now, manufacturers can beat the rush when registration eventually becomes a formal requirement.

- It’s Free: There are currently no government fees for voluntary review. While there is no official guidance, it is expected that devices registered voluntarily will be grandfathered into the new regulation system, avoiding the future registration fees.

- Keep up with the Market Leaders: Manufacturers will have a difficult time gaining traction with private hospitals in a market with a long history of high level healthcare provided by some of the best companies in the world. The top 20 largest medical device companies in the world participate in the voluntary system, therefore competing with market leaders in the private hospital sphere requires registration. Unless your product is extremely novel, private hospitals will prioritize registered products.

FOLLOWING THE MONEY

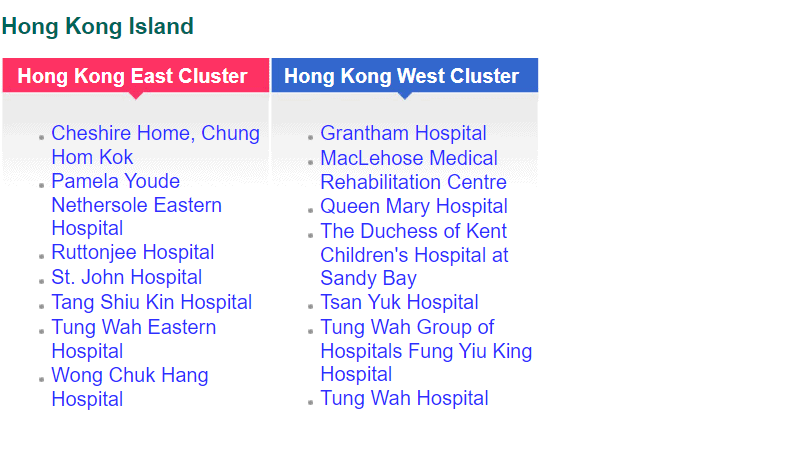

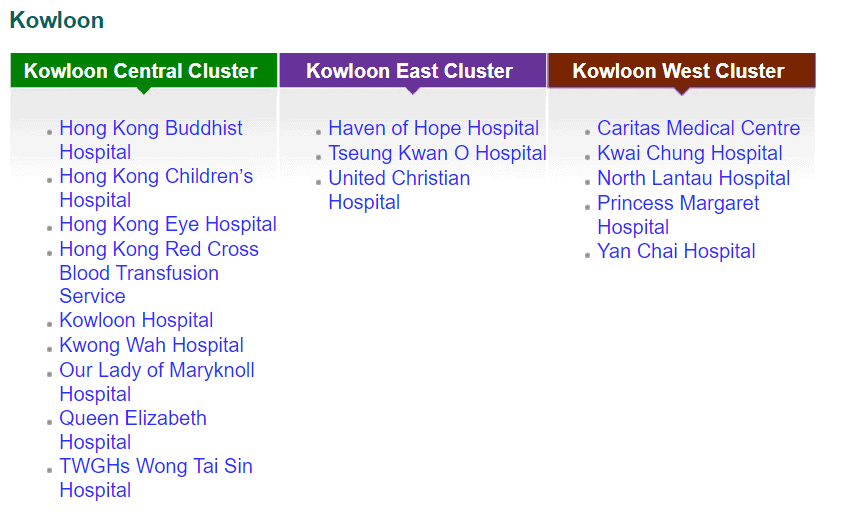

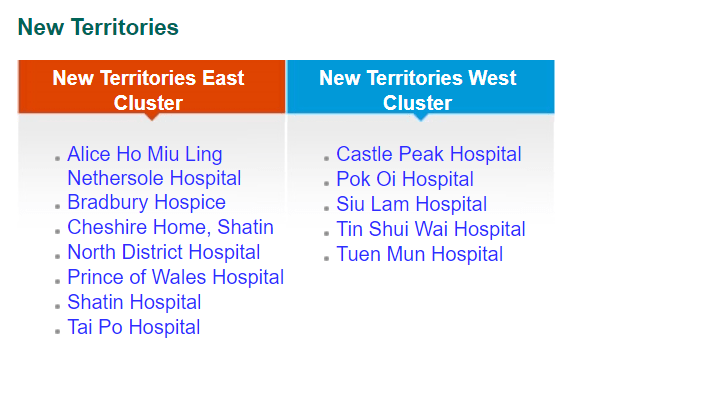

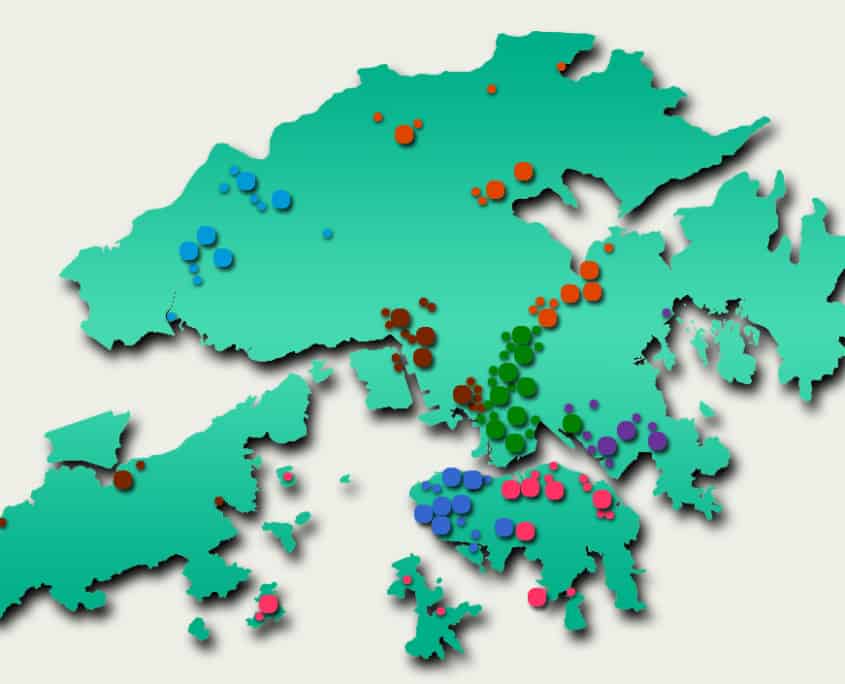

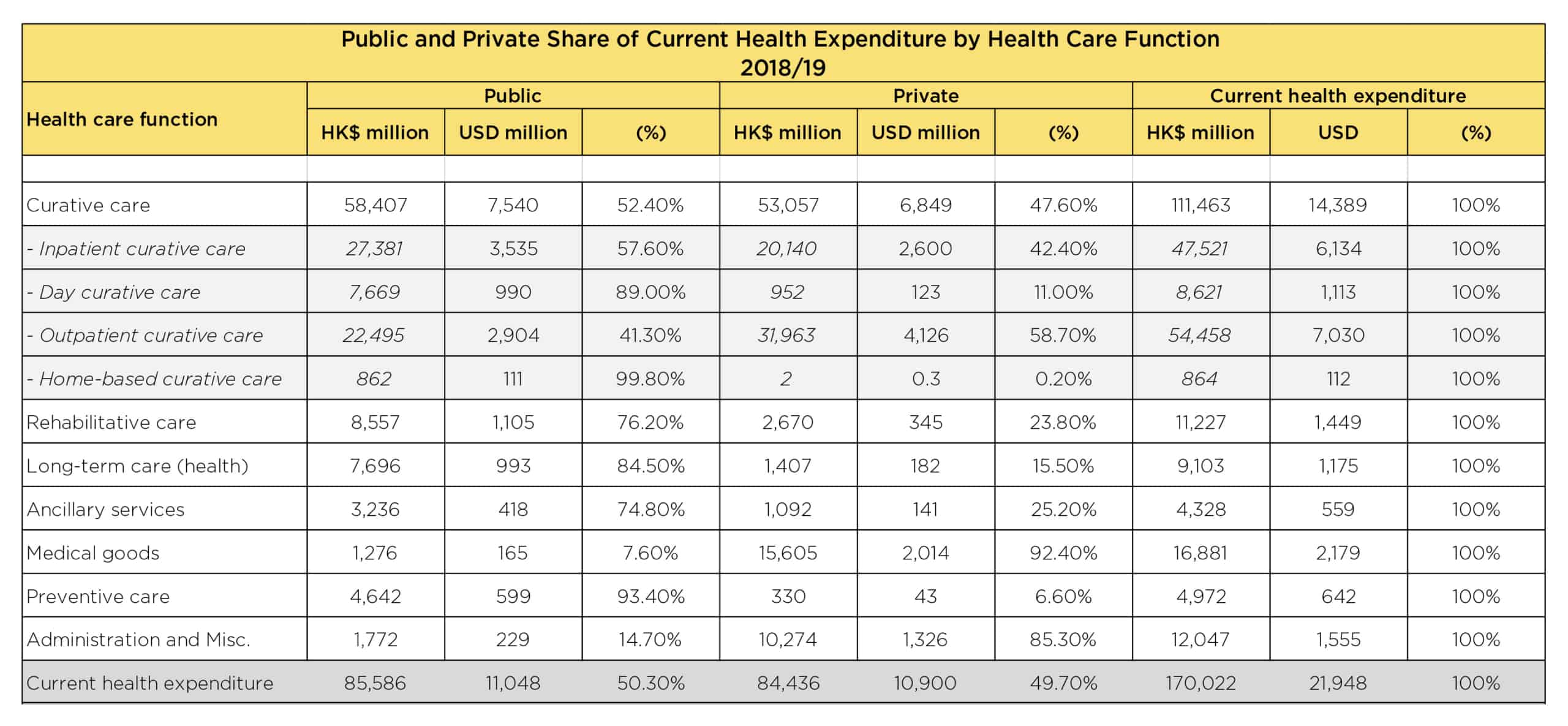

While private funding has steadily increased in recent years, publicly funded services continue to make up the bulk of the medical device market. According to government data, in 2018-2019, expenditure at public hospitals was almost US$8B compared to US$3.1B spent at private hospitals, representing 71% of the market. Public funding continues to dominate additional sectors such as long-term care (81%), ancillary services (75%) and preventative care (98%), while private funding handles the majority of ambulatory healthcare and retailers. The public hospital system, administered by the Hospital Authority (HA), consists of 43 hospitals, 49 Specialist Out-Patient Clinics and 73 General Out-Patient Clinics spread throughout seven “clusters.” The HA organizes public tenders on behalf of specific hospitals for both pharmaceuticals and medical devices. Current active tenders include Foley catheters, X-Ray machines, and Endoscopic Video Systems.

Distribution of Clusters, Hospitals & Institutions

Asia Actual has extensive market data available upon request

Facilities by Region

HEALTHCARE EXPENDITURE IN HONG KONG

Below is a more detailed breakdown of the public and private healthcare expenditure in Hong Kong during 2018-2019.

WHO IS VOLUNTARILY REGISTERING?

Using Asia Actual’s unique insights into the registered products in Hong Kong, the information below provides a snapshot of who is registering their products, in addition to some of the most common product types according to the Asian Medical Device Nomenclature System (AMDNS). In Hong Kong, five companies account for 839 active registrations. In total, there are 1,031 different medical device companies accounting for 5,216 registrations of 1,173 AMDNS codes.

| Manufacturer | Quantity of Models | Quantity of Unique AMDNS |

|---|---|---|

| Medtronic | 216 | 89 |

| Boston Scientific | 192 | 84 |

| Cook | 177 | 83 |

| Covidien | 140 | 85 |

| GE | 123 | 37 |

Get your free ADMNS report today

Learn more about your product’s AMDNS code in Hong Kong

MOST COMMON AMDNS CODES

According to our research, catheters, guide wires and stents are the most common type of AMDNS code registered with the MDD. Catheters, like in most markets, are a common item registered in Hong Kong. There are 89 different AMDNS terms for the various catheter categories, with 608 different products. Take vascular guiding catheters for example, the lowest risk classification for this category is a Class II, while the highest is Class IV. In terms of competition, there are 26 manufacturers with 65 different active registrations. Looking further into our data, there are 16 Class II registrations and 49 Class IV.

| AMDNS Term | Manufacturers | Registered Products | Lowest Class | Highest Class |

|---|---|---|---|---|

| Catheters, Vascular, Angioplasty, Ballon | 37 | 117 | 2 | 4 |

| Guide Wires | 29 | 129 | 2 | 4 |

| Catheters, Vascular, Guiding | 26 | 65 | 2 | 4 |

| Tissue Reconstructive Materials, Fluid | 25 | 77 | 4 | 4 |

| Catheters, Vascular, Embolectomy/Thrombectomy | 19 | 23 | 2 | 4 |

| Stents, Vascular, Coronary, Ballon-Expandable, Drug-Eluting | 17 | 40 | 4 | 4 |

| Scanning Systems, Ultrasonic, General Puporse | 16 | 63 | 2 | 2 |

| Stents, Vascular, Coronary, Balloon-Expandable | 16 | 25 | 4 | 4 |

| Contact Lenses, Vision Corrective | 15 | 73 | 2 | 2 |

| Lenses, Intraocular, posterior Chamber | 15 | 65 | 3 | 4 |

| Viscoelastic Solutions, Intra-articular | 15 | 24 | 4 | 4 |

REGISTERED PRODUCTS IN HONG KONG vs. SINGAPORE

Even though Hong Kong may attract all of the big players, most manufacturers selling in Hong Kong enjoy less competition than in the nearby medical hub of Singapore, where there’s 2.5 times more devices registered. While some of the difference can be attributed to variations in grouping requirements, the differences aren’t significant. When it comes to market size, Hong Kong and Singapore have a similar total healthcare expenditure of about US$23-25B per year. Singapore’s total expenditure is slightly larger than in Hong Kong, though Singapore’s population is almost 2 million less people. The majority (62%) of expenditure in Singapore is privately funded, with a notable portion coming from medical tourism, primarily from neighboring Malaysia and Indonesia. On the other hand, Hong Kong has a 50-50 breakdown when it comes to public versus private funding. Due to both countries’ aging populations, each government has pledged to increase government subsidies to further support the elderly in the years to come.

Hong Kong

| Class | Registered Products by Class | Percent |

|---|---|---|

| II (MD) | 1,768 | 33.88% |

| III (MD) | 1,796 | 34.42% |

| IV (MD) | 1,654 | 31.70% |

| Total | 5,218 | 100% |

Singapore

| Class | Registered Products by Class | Percent |

|---|---|---|

| II (MD) | 7,681 | 54.17% |

| III (MD) | 4,339 | 30.60% |

| IV (MD) | 2,159 | 15.23% |

| Total | 14,179 | 100% |

CONTACT ASIA ACTUAL TODAY

Asia Actual has a fully licensed office in Hong Kong (including a Radio Dealers License for importing devices that include wireless technology) staffed by high level regulatory professionals. Please contact us with questions about the new program or our regulatory and Local Responsible Person (license holding) services.